Dataciders, one of the leading providers of data, analytics, and AI services in Germany, continues to extend its market leadership in the DACH region by acquiring the IT services provider PRODATO. This acquisition enables Dataciders to expand its service and customer portfolio, industry expertise, regional presence, network of technology partners, and pool of software engineers and consultants.

PRODATO, based in Nuremberg, is an established IT services company specialized in data and analytics solutions for mid-sized and large companies in the DACH region. With 175 employees, PRODATO offers project-based data and analytics consulting services, software licenses, and other services. The company is known for its expertise in data integration, process automation, AI, data governance and regulation, and corporate performance management. PRODATO’s customer base includes the food retail, pharmaceutical, and industrial sectors. It is Dataciders’ second acquisition since Rivean Capital’s entry in January 2024.

Rivean Capital is a leading European private equity investor in mid-market transactions with operations in the DACH region, Benelux, and Italy and assets under management in excess of €5bn.

CODEX Partners provided the Commercial Due Diligence of PRODATO for Dataciders.

CODEX Partners advises investors on commercial due diligence and vendor due diligence, on strategy development, cost optimozation and restructuring of portfolio companies as well as on the development of industry platforms. Investors benefit from our experience from more than 700 projects.

The proLogistik Group (pLG), a portfolio company of Elvaston Capital Management GmbH/Berlin, optimizes all processes along the supply chain with its software and hardware products. In the four areas of Warehouse, Transportation, Hardware and Consulting, the group offers solutions for seamlessly integrated logistics processes. The pLG Product Suite comprises customer-oriented software for a digitalized supply chain. Customers benefit from maximum efficiency and significant time and cost savings across all process chains. The group of companies is represented by 700 employees in Germany, Austria, France, Switzerland, Mexico, the USA, and Canada and has more than 2,000 customers.

CODEX Partners provided the Commercial Vendor Due Diligence of proLogistik Group for the successful refinancing.

CODEX Partners advises investors on commercial due diligence and vendor due diligence, on strategy development and transformation of portfolio companies as well as on the development of industry platforms. Investors benefit from our experience from about 700 projects.

SMG is a leading supplier of machines for synthetic sports surfaces that offers unique solutions for track, turf, and hybrid surfaces. SMG provides machinery to automate the complete lifecycle of sports surfaces, offering installation, maintenance, and reclamation machinery. While SMG markets its products around the globe, equipment is manufactured in its German headquarters in Vöhringen.

The objective of the partnership is to support SMG’s growth ambitions with capital and expertise. SMG plans to further expand its geographical footprint as well as accessing new customer segments with new innovative equipment for artifiial and hybrid sports surfaces.

Gimv is a European investment company, listed on Euronext Brussels and a member of the Euronext BEL ESG Index. With over 40 years’ experience in private equity, Gimv currently has a portfolio of more than EUR 1.5 billion containing around 60 portfolio companies, with combined turnover of EUR 4.0 billion and more than 20,000 employees.

CODEX Partners provided the Commercial Due Diligence of SMG Sportplatzmaschinenbau for Gimv.

CODEX Partners advises investors on commercial due diligence and vendor due diligence, on strategy development and transformation of portfolio companies as well as on the development of industry platforms. Investors benefit from our experience from about 700 projects.

Freihoff Sicherheitsservice GmbH, headquartered in Germany and employing ~250 people, offers end-to-end electronic security solutions, including planning, installation, repair, maintenance and 24/7 alarm monitoring services and is well known for complex and technologically challenging security solutions realized for its small- to blue-chip customer base.

Garda Sikring is a leading Nordic company for technical security. The Group offers installation, service and maintenance within perimeter and mechanical security, technical and electronic security, road safety, and industrial doors for real estate, critical infrastructure, traffic and construction, industry, and public companies across Norway, Sweden, Denmark, and Finland.

Garda Sikring is the market leader in each of the Nordic countries within perimeter security. With this strategic acquisition, the Group expands into the German electronic security market and continues its buy-and-build strategy.

EMK Capital is an international private equity firm. Over the last 20 years, EMK Capital ‘s founders achieved an EBITDA growth of >25% CAGR on average across all realized investments and following extensive add-on strategies.

CODEX Partners provided the Commercial Due Diligence of Freihoff Sicherheitsservice GmbH for Garda Sikring and EMK Capital. The CODEX Partners project team was led by Clemens Beickler and Jens Nattermann.

CODEX Partners advises clients on Commercial Due Diligence, Vendor Due Diligence, strategy development and transformation, as well as on developing industry platforms. Our clients benefit from our experience of c. 700 projects.

Virthos Partners is an independent, owner-operated investor. In collaboration with entrepreneurs and entrepreneurial families, Virthos engages in well-established mid-sized companies in Germany and neighboring countries, focusing on long-term investments and the strategic and operational development of these enterprises.

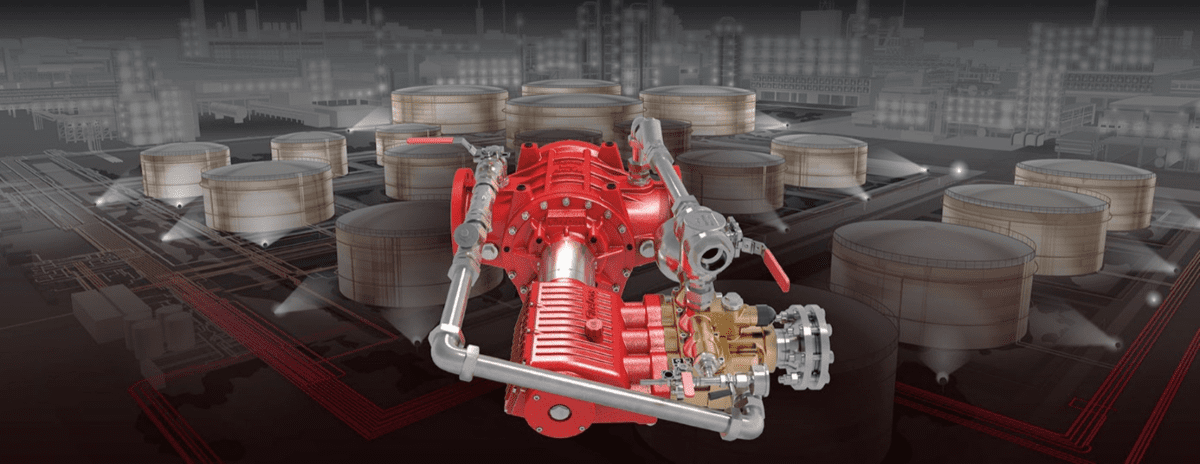

In November 2023, Virthos Partners successfully completed the refinancing of its investment in FireDos GmbH.

FireDos is a market-leading manufacturer of high-quality foam proportioning systems and fire monitors. The product range extends from stationary fire suppression systems to proportioning systems for vehicles and portable units. A unique feature of the FireDos systems is their contribution to ESG. These systems operate without external energy, can be used with environmentally friendly, fluorine-free extinguishing agents, and can be tested without the consumption of foam, thereby protecting human lives, facilities, and the environment.

Clients include large companies (e.g., in the chemical, energy, logistics industries), infrastructure operators (e.g., of seaports and airports), and fire departments.

Globally, more than 15,000 proportioning systems and over 1,000 fire monitors from FireDos are successfully in operation. The company employs over 100 staff at its headquarters in Wölfersheim and production sites in Germany and Poland.

CODEX Partners prepared the Commercial Factbook for FireDos GmbH.

CODEX Partners advises investors on Commercial Due Diligence and Vendor Due Diligence, on strategy development, cost optimization and restructuring of portfolio companies as well as on the development of industry platforms. Investors benefit from our experience from about 700 projects.

AddSecure, a leading European provider of secure IoT connectivity and end-to-end solutions, recently announced the acquisition of DigiComm Group, a leading German provider of solutions for critical infrastructure. The acquisition included three independent but mutually benefitting companies: DigiComm GmbH, Temeno GmbH, and Insert IT GmbH.

Through the acquisition of DigiComm Group, AddSecure expands its presence in the DACH region and gains access to a wide range of critical infrastructure expertise and offerings. Additionally, this strategic move allows AddSecure to enter the emerging area of digital waste management.

CODEX Partners provided the Commercial Due Diligence of DigiComm Group for AddSecure and its shareholders.

CODEX Partners advises investors on Commercial Due Diligence and Vendor Due Diligence, on strategy development, cost optimization and restructuring of portfolio companies as well as on the development of industry platforms. Investors benefit from our experience from about 700 projects.

Rivean Capital and the management team of Dataciders GmbH are acquiring the latter from investment funds advised by AUCTUS Capital Partners AG.

Headquartered in Dortmund, Germany, Dataciders is a group of companies specializing in IT services and one of the leading providers of data and analytics services in Germany. With over 500 employees, the group focuses on end-to-end data and analytic solutions and enables companies to efficiently collect data across multiple domains and utilize it to make intelligent decisions.

The goal of the partnership between Rivean and Dataciders is to provide the group with capital and strategic expertise for the next phase of its growth and to establish it as the segment leader in the German-speaking region (DACH).

CODEX Partners provided the Commercial Due Diligence of Dataciders for Rivean Capital.

CODEX Partners advises investors on Commercial Due Diligence and Vendor Due Diligence, on strategy development, cost optimization and restructuring of portfolio companies as well as on the development of industry platforms. Investors benefit from our experience from about 700 projects.

Holl Flachdachbau GmbH & Co. KG Isolierungen, a subsidiary of Dutch Primutec Solutions Group, is strengthening its position in the German market for rooftop photovoltaic systems with the acquisition of a majority stake in Clen Solar GmbH & Co. KG. The founder of Clen Solar will remain significantly invested and will continue to actively support the strong growth of the group. Primutec Solutions Group is a portfolio company of funds advised by Deutsche Private Equity (DPE).

CODEX Partners has strategically advised Holl Flachdachbau/Primutec on its investment in Clen Solar.

CODEX Partners advises clients on Commercial Due Diligence and Vendor Due Diligence, on strategy development and transformation, as well as on developing industry platforms. Investors benefit from our experience from more than 700 projects.

Ardian, a world leading private investment house, has agreed to sell its stake in imes-icore Holding GmbH (“imes-icore”) to EMZ Partners, a leading European investment firm.

With the support of Ardian, imes-icore has more than doubled its revenue since 2017 and evolved from a developer of high-tech CNC-CAD/CAM systems and industrial machines to a solution provider focused exclusively on the dental sector.

imes-icore is one of the world market leaders for digital dental CAD/CAM production systems with locations in Germany, the USA and Southeast Asia. The company designs, develops and manufactures dental milling systems, which are accompanied by a broad portfolio of after-sales services. imes-icore’s products and services are characterized by continuous innovation and are known for their precision and advanced technology. The company is led by founder and CEO Christoph Stark and CFO/COO Christian Müller.

CODEX Partners provided the Commercial Vendor Due Diligence of imes-icore for Ardian.

CODEX Partners advises investors on Commercial Due Diligence and Vendor Due Diligence, on strategy development, cost optimization and restructuring of portfolio companies as well as on the development of industry platforms. Investors benefit from our experience from about 700 projects.

MEG Medical Equipment GmbH (Medical Equipment Group), parent company of Funke Medical GmbH, acquires 100% of the shares of Deron B.V., Lima B.V., and Connect Foam Care B.V. (collectively DERON). The acquisition is supported by Harald Quandt Industriebeteiligungen GmbH (HQIB), majority shareholder of Medical Equipment Group.

DERON is the leading provider of medical aids for the prevention and therapy of decubitus in the Netherlands. DERON is positioned as an innovation leader who differentiates itself from market peers through i.a. recyclable/circular products and software-based solutions for the care sector. The current management teams at DERON, Funke Medical, and Medical Equipment Group remain unchanged. Simone and Wilfried Grimberg, founders of DERON, become minority shareholders in Medical Equipment Group. DERON and Funke Medical remain operationally independent with their respective brands, however, will jointly collaborate along the group strategy.

CODEX Partners prepared the Commercial Due Diligence of DERON for Medical Equipment Group and HQIB.

CODEX Partners advises investors on Commercial Due Diligence and Vendor Due Diligence, strategy development and transformation as well as on developing industry platforms. Investors benefit from our experience of around 700 projects.