Funds advised by Odewald KMU (“Odewald KMU”) have acquired a majority stake in ctrl QS GmbH Rollout Management for Digital Projects.

ctrl QS is a specialist service provider that advises multinational corporations on process, tool and change management in digital projects and provides operational support to its customers. In its core market, ctrl QS has a leading market position and has many opportunities to expand its product range and to continue to grow successfully nationally and internationally. A key competitive advantage of ctrl QS is its in-depth understanding of the processes and challenges of its customers and its many years of experience in the successful handling of cross-system digital projects. In addition, further growth is to be realized through targeted add-on acquisitions. The Berlin-based company was founded in 2009 and today employs over 100 people.

Together with the founder, Mirja Silverman, who will continue to lead the company as managing partner, the successful growth strategy of the company shall be continued.

CODEX Partners prepared the Commercial Due Diligence of ctr QS for Odewald KMU.

CODEX Partners advises investors on commercial and vendor due diligence, on strategy development, cost optimization, and restructuring of portfolio companies as well as on the development of industry platforms. Investors benefit from our experiences from over 500 projects.

Schürfeld Group, Hamburg, takes over the majority of the advertising media company Geiger-Notes. Schürfeld Group is a medium-sized family company that invests mainly in medium-sized enterprises in the paper and printing industry. The previous owner of Geiger-Notes AG, Jürgen Geiger, who has founded the company, remains connected to the company as CEO and shareholder.

Geiger-Notes AG, headquartered in Mainz-Kastell, is a leading manufacturer of calendars, sticky notes, notebooks and print advertising materials. With more than 200 employees, the company produces 15 million calendars and sticky notes annually in digital and offset printing. The company achieves sales of around EUR 30 million.

CODEX Partners has prepared the Commercial Due Diligence of Geiger-Notes.

CODEX Partners supports investors in commercial and vendor due diligence, in strategy development and value enhancement projects for portfolio companies and in buy & build platforms. CODEX Partners has served clients in more than 500 projects.

DWS S.r.l. (www.dwssystems.com) designs and produces 3D printers for prototyping and rapid manufacturing, materials for 3D design, and related software. Quality and continuous innovation are the company’s distinctive features. The company which is based in Thiene (Italy) is one of the most innovative in the sector with over 250 industrial, design and technology patents filed since 2007. DWS exports 80% of its production to more than 60 countries worldwide, with a focus in the jewelry, fashion, industrial and dental sectors. DWS is a supplier to prestigious fashion and luxury houses, among which are Bulgari, Tiffany and Cartier, and also to multinational industrial groups such as Samsung, Bose, Panasonic and Sony. The dental division, with its unique DFAB solution, is a major innovator in this sector. It has accelerated the digitization process with benefits in terms of time, cost and quality for the customer. The DFAB system has also received the Red Dot Award for industrial design in 2018.

B.group S.p.A. (www.bgroup.it) has underwritten a reserved capital increase to accelerate DWS’ strategic growth. B.group aims to strengthen the managerial team and sales network, and enhance the existing innovative solutions offered to the industrial, luxury and dental sectors. B.group S.p.A. is an entrepreneurial private equity group which directly invests capital in selected highly innovative small- and medium-sized firms. They aim to strengthen their development and growth through long-term capital increases, expertise, and international networks.

CODEX Partners prepared the Commercial Due Diligence of DWS for B.group.

CODEX Partners supports investors in commercial and vendor due diligence, in strategy development and value enhancement projects for portfolio companies and in buy & build platforms. CODEX Partners has served clients in more than 500 projects.

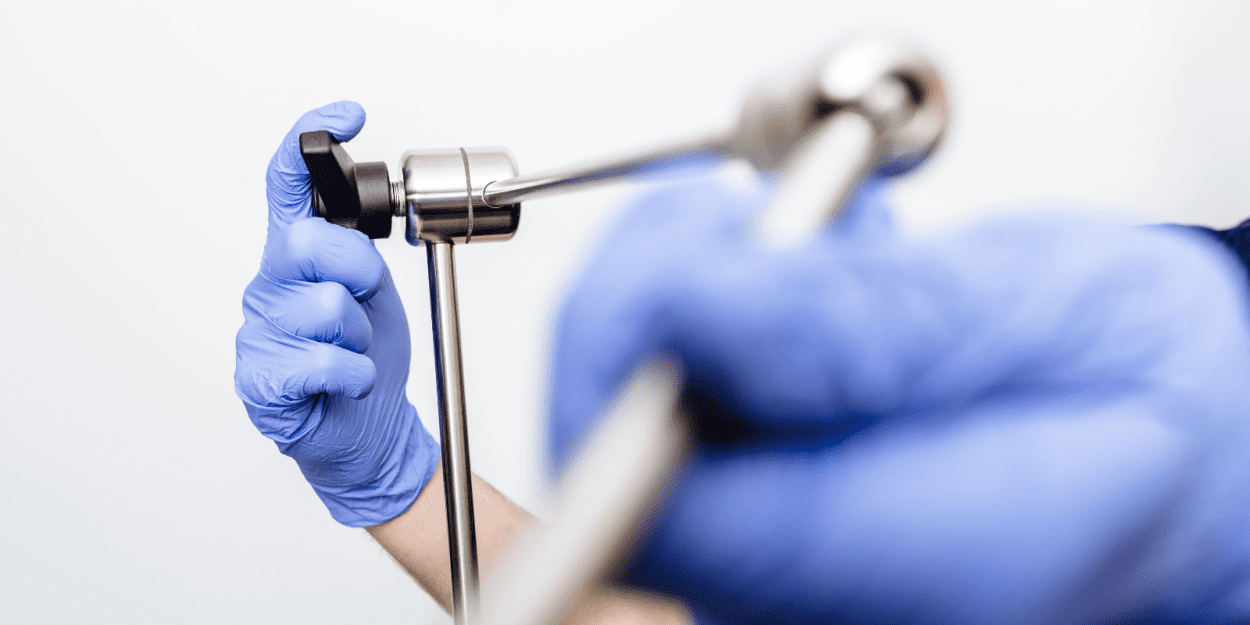

As part of the succession plan HANNOVER Finanz takes a majority stake in the dental technology company Dental Direkt GmbH. The founder and family entrepreneur Gerhard de Boer will remain as a shareholder of the company. The managing directors Marcel Brüggert and Marvin Kühme will also become shareholders.

Dental Direkt, based in Spenge in North Rhine-Westphalia/Germany, is a digital full-service partner of dental laboratories. The company supplies its customers with own- produced milling blanks, CAD/CAM equipment and implant components. Dental Direkt also offers its customers a manufacturing service for complex dental prosthetics produced in its own technology center. The heart of the company is one of the most modern, automated production facilities for milling blanks for the dental industry. The company has grown steadily since it was founded in 1997 and today employs more than 100 employees. In the current financial year sales of around EUR 30 million are expected. Dental Direkt supplies customers in more than 60 countries worldwide.

CODEX Partners prepared the Commercial Due Diligence of Dental Direkt.

CODEX Partners supports investors in commercial and vendor due diligence, in strategy development and value enhancement projects for portfolio companies and in buy & build platforms. CODEX Partners has served clients in more than 500 projects.

VR Equitypartner, INVICTO Holding and the management have sold all shares in United MedTec Holding GmbH (UMT) to the listed GESCO AG, an industrial group with market and technology-leading medium-sized companies. At the same time, the UMT subsidiaries, W. Krömker GmbH and Tragfreund GmbH, are transferred to the new owner.

W. Krömker GmbH, founded in 1976, with around 60 employees, is a leading developer and manufacturer of medical technology accessories. The main product groups include support arms, articulated arms, holding systems and trolleys, which are often patented and developed together with customers. All well-known medical OEMs are represented in the company’s customer portfolio.

CODEX Partners prepared the Commercial Vendor Due Diligence of Krömker.

CODEX Partners supports investors in commercial and vendor due diligence, in strategy development and value enhancement projects for portfolio companies and in buy & build platforms. CODEX Partners has served clients in more than 500 projects.

ARMIRA has acquired a majority stake in Salesfive. Salesfive GmbH is a leading digital transformation consultancy and top five full-service Salesforce partner in German-speaking Europe.

Founded in 2017 and headquartered in Munich, Germany, Salesfive is a strategic digitalisation and IT sparring partner shaping digital transformation pathways for its clients. The company offers full-service solutions along the entire project lifecycle and across the entire Salesforce software suite. It has a highly sought-after and constantly growing platform of around 100 Salesforce experts with over 270 Salesforce certificates. Salesfive is uniquely positioned and has an ever-increasing and sticky customer base ranging from medium-sized companies to blue-chips.

ARMIRA is a holding group focused on equity investments between €20m to €200m in market-leading medium-sized “Mittelstand” businesses in Germany, Austria and Switzerland (DACH). With its unique capital base from entrepreneurs and entrepreneurial families, ARMIRA has the flexibility to invest without a fixed term and can focus on the long-term development of its portfolio companies.

CODEX Partners provided the commercial due diligence of Salesfive for ARMIRA.

CODEX Partners advises investors on commercial and vendor due diligence, on strategy development, cost optimization, and restructuring of portfolio companies as well as on the development of industry platforms. Investors benefit from our experiences from over 500 projects.

CODEX Partners advised Warburg Pincus and its portfolio company Infoniqa, a fast-growing provider of HR software and payroll services, on the acquisition of Sage Schweiz AG (“Sage Switzerland”), one of the leading HCM & ERP software vendors in the Swiss market.

Warburg Pincus acquired Austria-based Infoniqa, one of the fastest growing HR software companies in the DACH region, in September 2020. The acquisition of SAGE Switzerland further expands its presence in Switzerland, nearly doubling annual revenues to EUR 60m and increasing the number of employees to a total of 410.

The acquisition especially strengthens Infoniqa’s positioning in the strategically important segment of small and medium-sized enterprises. Its product portfolio will be broadened to include ERP solutions, financial management software as well as payroll and HCM solutions tailored to local Swiss requirements. These products are highly compatible with Infoniqa’s offering, resulting in excellent synergy potential.

CODEX Partners provided the commercial due diligence of Sage Switzerland for Infoniqa.

CODEX Partners advises investors on commercial and vendor due diligence, on strategy development, cost optimization, and restructuring of portfolio companies as well as on the development of industry platforms. Investors benefit from our experiences from over 500 projects.

German Equity Partners V, a private equity fund managed by the independent German investment company ECM Equity Capital Management GmbH (‘ECM’), has acquired a majority stake in Ludwigsburg-based ACADEMY Group, the leading provider of invoicing, factoring, driving instructor training and franchise services in the German driving school market. GEP V acquired the shares from a long-standing private investor.

As a leading specialist in invoicing services and factoring for driving schools with an annual factoring volume of approx. 170 million EUR, DATAPART Factoring GmbH forms the core of the ACADEMY Group. Around this offering, the Group has established a number of other services along the value chain of driving schools. The subsidiary DVPi operates facilities for driving instructor training in Frankfurt am Main and Hamburg. In addition, under the umbrella brand ACADEMY, the Group operates the largest franchise system for driving schools in Germany at more than 300 locations.

CODEX Partners provided the commercial due diligence of the ACADEMY Group for ECM.

CODEX Partners advises investors on commercial and vendor due diligence, on strategy development, cost optimization, and restructuring of portfolio companies as well as on the development of industry platforms. Investors benefit from our experiences from over 500 projects.

German Equity Partners V (“GEP V”), a fund managed by independent German investment company ECM Equity Capital Management GmbH (“ECM”), has acquired a majority equity interest in telematics software specialist YellowFox GmbH (“YellowFox”) in the context of a partnership investment.

YellowFox offers modular, cloud-based software-as-a-service (SaaS) solutions for digital fleet and object management. The company is one of the fastest-growing providers of intelligent telematics solutions in Europe. Some 60,000 vehicles and movable assets – such as heavy trucks, vans, passenger cars, construction machinery and containers – are already equipped with telematics solutions provided by YellowFox. These significantly contribute to more transparency, productivity,cost savings as well as compliance with applicable regulations. The company was founded in 2003 with headquarters in Kesselsdorf near Dresden and employs 70 people today.

CODEX Partners supported the Commercial Due Diligence of YellowFox for ECM Equity Capital Management.

CODEX Partners supports investors in commercial and vendor due diligence, in strategy development and value enhancement projects for portfolio companies and in buy & build platforms. CODEX Partners has served clients in more than 500 projects.

NORD Holding has acquired a majority stake in Dr. Födisch Umweltmesstechnik AG. The transaction was executed with the participation of WMS Wachstumsfonds Mittelstand Sachsen. The Födisch family as well as the founder and Chairman of the Board of Directors Dr. Holger Födisch also remain shareholders of the company. Together with NORD Holding and WMS the aim is to expand the market position and to continue the successful growth course of recent years.

Dr. Födisch Umweltmesstechnik AG is a leading manufacturer of emission technology for monitoring environmentally harmful gases, dust, and volume flows. Fields of application are emission monitoring (CEMS: Continuous Emission Monitoring Systems), process and environmental measurement technology and recurring tests of stationary measuring equipment. The medium-sized company operates in a market environment that has been growing steadily for years, driven by global megatrends and stricter environmental regulations. Dr. Födisch Umweltmesstechnik AG currently has more than 180 employees.

CODEX Partners provided the Commercial Due Diligence of Dr. Födisch Umweltmesstechnik AG for NORD Holding.

CODEX Partners advises investors on commercial and vendor due diligence, on strategy development, cost optimization, and restructuring of portfolio companies as well as on the development of industry platforms. Investors benefit from our experiences from over 500 projects.