CODEX Partners advises Virthos Partners on the refinancing of FireDos GmbH

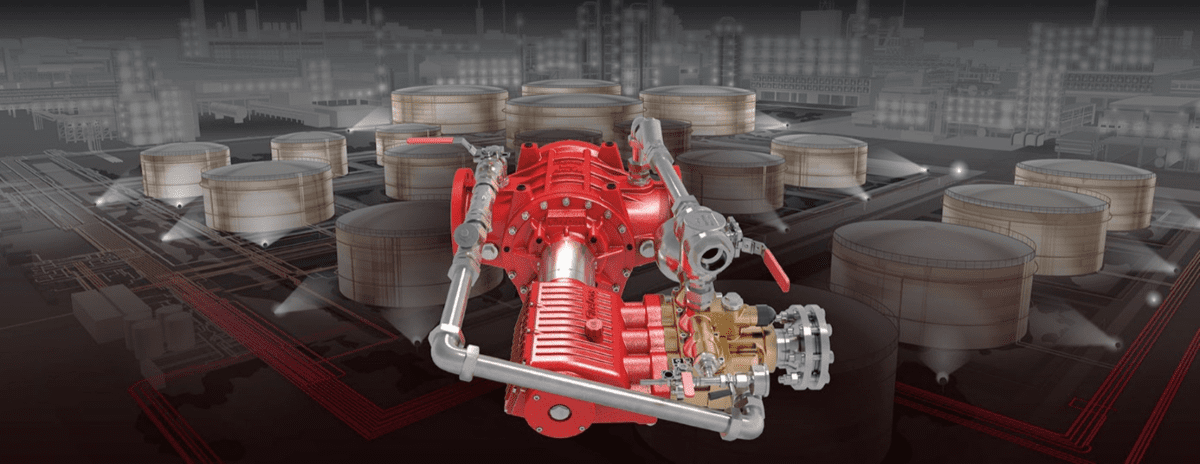

Virthos Partners is an independent, owner-operated investor. In collaboration with entrepreneurs and entrepreneurial families, Virthos engages in well-established mid-sized companies in Germany and neighboring countries, focusing on long-term investments and the strategic and operational development of these enterprises. In November 2023, Virthos Partners successfully completed the refinancing of its investment in FireDos GmbH. FireDos is

- Published in Deal News

CODEX Partners advises AddSecure Group, a portfolio company of funds managed by Castik Capital, on the acquisition of DigiComm Group

AddSecure, a leading European provider of secure IoT connectivity and end-to-end solutions, recently announced the acquisition of DigiComm Group, a leading German provider of solutions for critical infrastructure. The acquisition included three independent but mutually benefitting companies: DigiComm GmbH, Temeno GmbH, and Insert IT GmbH. Through the acquisition of DigiComm Group, AddSecure expands its presence

- Published in Deal News

CODEX Partners advises Rivean Capital on the acquisition of Dataciders

Rivean Capital and the management team of Dataciders GmbH are acquiring the latter from investment funds advised by AUCTUS Capital Partners AG. Headquartered in Dortmund, Germany, Dataciders is a group of companies specializing in IT services and one of the leading providers of data and analytics services in Germany. With over 500 employees, the group

- Published in Deal News

CODEX Partners advises Holl Flachdachbau, a subsidiary of Primutec (DPE), on the acquisition of Clen Solar

Holl Flachdachbau GmbH & Co. KG Isolierungen, a subsidiary of Dutch Primutec Solutions Group, is strengthening its position in the German market for rooftop photovoltaic systems with the acquisition of a majority stake in Clen Solar GmbH & Co. KG. The founder of Clen Solar will remain significantly invested and will continue to actively support

- Published in Deal News

CODEX Partners advises Ardian on the transaction of imes-icore to EMZ Partners

Ardian, a world leading private investment house, has agreed to sell its stake in imes-icore Holding GmbH (“imes-icore”) to EMZ Partners, a leading European investment firm. With the support of Ardian, imes-icore has more than doubled its revenue since 2017 and evolved from a developer of high-tech CNC-CAD/CAM systems and industrial machines to a solution

- Published in Deal News